New Stamp Duty Rates – April 2016

From April a new stamp duty rate will be introduced, with an extra 3% charge. If you already own a property, any other property you purchase with be hit with this higher stamp duty rate. This charge even effects properties under £125,000.

Here are the existing and proposed SDLT rates:

| Purchase price | Existing residential SDLT rates | Proposed additional rates |

|---|---|---|

| Up to £125,000 | 0% | 3% |

| Over £125,001 to £250,000 | 2% | 5% |

| Over £250,001 to £925,000 | 5% | 8% |

| Over £925,001 to £1.5 million | 10% | 13% |

| Over £1.5+ million | 12% | 15% |

These higher SDLT rates will only apply to additional properties purchased in England, Wales and Northern Ireland on or after April 1 2016.

Who will be affected?

Anyone buying another property that isn’t their main residence will pay the extra stamp duty charges.

So you’ll have to pay the extra 3% stamp duty if:

- You own a home and you are buying another property (as a second home or to property to let)

- You are replacing a property you already own and don’t live in

You don’t have to pay the extra stamp duty if you are changing your main residence (your home). So if already own properties or own a second home, but you plan on buying moving to a new home and sell your old one, you don’t have to pay the additional charges.

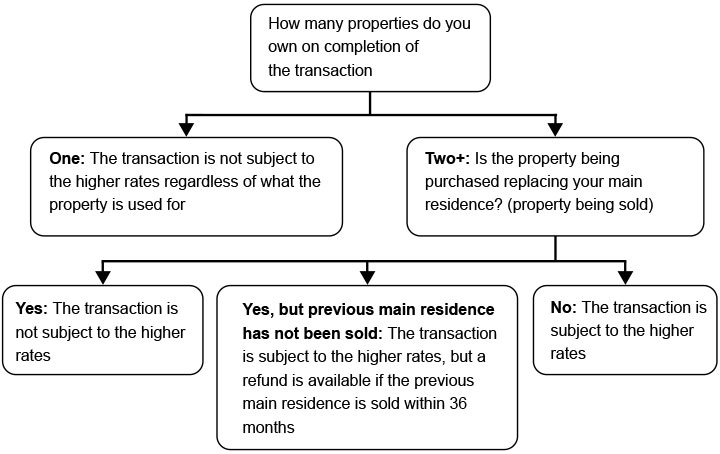

It’s all a bit complicated… here’s a handy flow diagram below that shows who will be affected. This was actually included in the Government consultation:

Example

For example, anyone buying a private home for £200,000 will pay a stamp duty of £1,500. They’ll pay 0% on the first £125,000 of the property value and 2% on the portion between £125,001 and £250,000.

Anyone buying a second property will have to pay 3% for the first £125,000 and 5% (instead of 2%) on the amount between £125,001 and £250,00. That gives them a total bill of £7,500!

The Exemptions

There are some types of property that won’t fall under the stamp duty charges. These include:

- Caravans and houseboats

- Property worth less than £40,000

- Social landlords (Charities)

- Multiple purchases (15 or more properties)

Why have they increased the stamp duty rate for additional properties?

The aim of this new stamp duty rate is to discourage landlords and property investors from buying up ALL the available houses in the UK. This should free up more homes for first-time buyers that are currently struggling to get on the property ladder. The Treasury is also trying to close any loopholes people could use to beat the new stamp duty rates.

What do you think? Are these additional Stamp Duty charges a good idea?

I can understand why the government are making these changes, but I’m not sure this is the best way to free up properties for potential first time buyers.